At the time of writing AVAX is being traded at the rate of $55.62 with an increase of 1.55% within the last 24 hours.

Top 5 Tech Stocks to Buy in 2024

Don't let the chaos of rising interest rates, potential recession, tighter credit issues, higher oil prices, and incessant geopolitical issues chase you from the markets. Instead, just wait it out. With too much fear in the market, go bargain hunting with tech stocks. We have complied a report with the five of the best ways to profit within this industry.

"Top 5 AI Stocks to Buy in 2024."

Click here to sign up for our free report & newsletter, plus bonus offer "Elon Musk just Tiggered a BOOM in These Stocks"

Sponsored

The low within this tenure was around $54.21 and the high was approximately $56.43. The coin as being in the watchlist of many traders makes it ranking all the way up to number 16 according to the latest data release by coin market cap.

AVAX made its all time high in the month of September 2021 where it reached an enormous amount of $79.80. At the moment it has a daily volume of $329,898,915 with a decrease of 11.93% within the last 24 hours. The circulating supply of AVAX is now around 220,286,577.21 AVAX with a dominance of 0.50.

The top exchanges for trading in ICON are currently Binance, Coinbase, Huobi Global, Bitfinex, Gate.io, Kucoin and more.

AVAX Technical analysis:

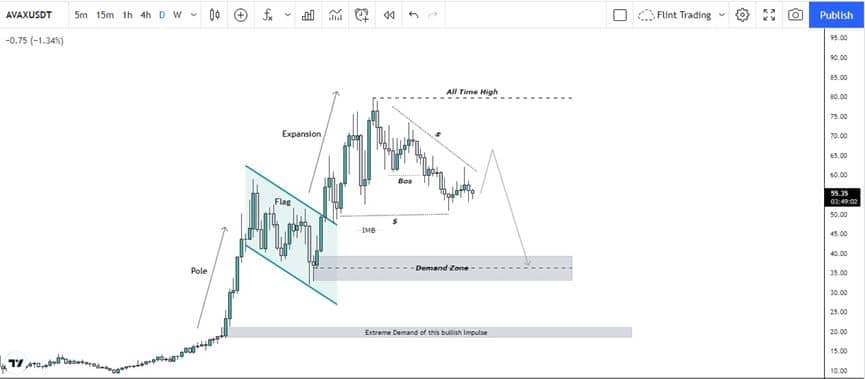

AVAX from July to the first week of September has been printing bullish candles on a weekly time frame showing that bulls are in control.

The start of the impulsive move was through a pole flag pattern which originated from 17th August 2021. From 24th August to 8th of September, the market stayed in a bullish flag, and soon after that, the price again pushed to the upside completing the expansion move. Now, this move actually made this coin a new all-time high which is at $79.80.

The price once reaching this top, then started to lose momentum which resulted in a break of structure to the downside indicating a change in structure.

Now the expansion move actually left imbalance and liquidity which can drive the price to the downside. But the question is when? Is it currently a good time? well, as the price is pushing down its clearly respecting the trendline, so obviously trendline traders will be trailing their stop losses along the way, so it is likely that these will be stop hunted and then a move towards downside can be observed. This move can end till the demand zone is present at $36.35.

Now this zone be the first target, as this zone can hold price and cant as well. Just below this an extreme zone is present, which actually originated the pole flag move, so much buyers are sitting there and those have to get mitigated in order for the market to remain healthy along the way.

In case if price breaches the level of $74.02, it is likely that it would then go over to mitigate the all-time high move.