At the time of writing Uniswap is being traded at the price of $27.55. In the past 24 hours, the price has increased by almost 4.49%. The daily trading volume has also increased by almost 114.96% and now stands at $475,503,115,804. Uniswap stands at the 13th spot in coinmarketcap and has a market dominance of about 0.65%. Uni created its all-time high around the price of $45 during the month of May 2021 before dropping to the price of $13. Uniswap is one of the most famous DEX that allows the exchange of ERC-20 tokens.

Top 5 Tech Stocks to Buy in 2024

Don't let the chaos of rising interest rates, potential recession, tighter credit issues, higher oil prices, and incessant geopolitical issues chase you from the markets. Instead, just wait it out. With too much fear in the market, go bargain hunting with tech stocks. We have complied a report with the five of the best ways to profit within this industry.

"Top 5 AI Stocks to Buy in 2024."

Click here to sign up for our free report & newsletter, plus bonus offer "Elon Musk just Tiggered a BOOM in These Stocks"

Sponsored

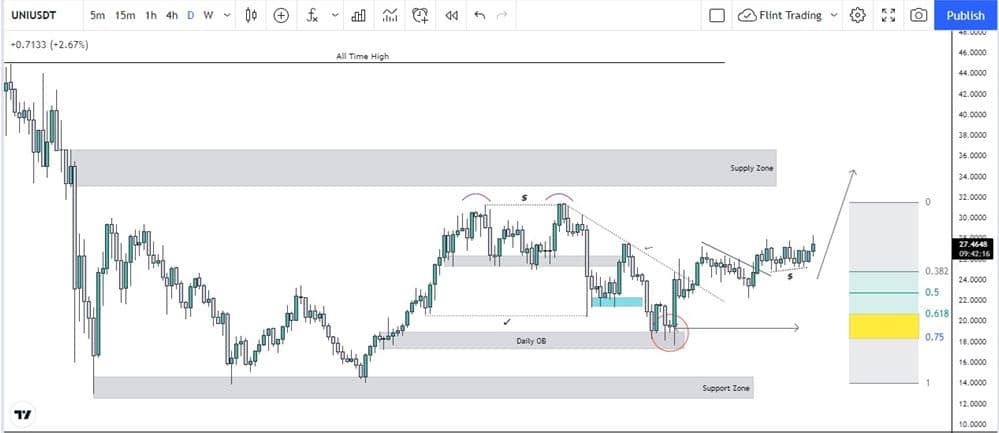

Technical Analysis Uniswap:

Starting from the monthly, Uniswap has been pumping up and up. the price reached $45.323 from $1.9961 within few months.

Right now the price seems to be in a correction phase and making a descending triangle. Shifting to the weekly time frame, the price is a consolidation and is indecisive for about 7 weeks and is ranging. Now going to the daily time frame, the price can still be considered bullish because of the evidences seen by the price action.

Price when was in the correction phase, left a supply zone which still remains intact and unmitigated. From 16th of August to 2nd of September, the price was just about to tap into that supply zone but it was unable to do so, and this unfolded a double top above which liquidity remains till date.

Now due to the presence of these two confluences, it is very likely to drive the price upwards till that supply zone. Now besides that, price as was being pushing down was respecting a trendline, which was broken on 1st of October. Now if this wasn’t enough, the bullish correction which confirms a trendline breakout too, occurred on the 14th of October giving more idea that the price wants to rally up.

Talking about the structure, the price as being said that was consolidating, so structures are being broken to the upside and downside continuously, but if only the recent structures are to be seen, it can be observed that price is exactly at the Lower High, and it is quite possible that it might broke that. After this correction breakout, the market is consolidating which might first push down, grabbing liquidity, and then continue to push up to the supply zone which is a reliable target. talking about invalidation, if the level of $22.238 doesn’t hold, then buys would not be preferred.